In the world of algo trading, backtesting and live trading are two critical phases that help traders and developers gauge the success of a strategy. While both stages serve the same ultimate purpose of improving trading performance, they each offer distinct advantages and challenges.

To achieve a successful trading strategy, understanding the differences between backtesting and live trading is crucial.

Table of Contents

What is Backtesting?

Backtesting is the process of testing a trading algorithm on historical market data to determine how well it would have performed. By running an algorithm against past market conditions, traders can simulate trades without risking real capital. The goal of backtesting is to evaluate the algorithm’s potential profitability and to identify any issues before live trading begins.

Benefits of Backtesting

- Risk-Free Evaluation: Backtesting allows traders to test strategies without putting real money at risk. This makes it easier to explore various strategies and refine them.

- Optimization: Traders can tweak their algorithms based on backtest results, adjusting parameters and risk management features to optimize performance.

- Quantitative Performance Metrics: Backtesting provides valuable performance metrics such as profit, loss, drawdown, and Sharpe ratio. These metrics help traders understand how the algorithm might behave under different market conditions.

- Strategy Validation: Backtesting helps traders confirm that their strategy aligns with their trading objectives, such as achieving a specific risk/reward ratio.

Why is Backtesting Important for Algo Trading?

Backtesting allows you to test your trading algorithm on historical data without risking real money. It helps identify potential weaknesses, optimize strategies, and evaluate performance metrics like win-loss ratios and Sharpe ratios. Backtesting gives you a glimpse of how your strategy would have performed in the past, boosting your confidence before live trading.

Drawbacks of Backtesting

While backtesting is a valuable tool, it has some limitations:

- Overfitting: One of the most common issues in backtesting is overfitting. This occurs when the algorithm is too closely tailored to historical data, leading to performance that may not be replicable in real trading scenarios.

- Ignoring Real-World Factors: Backtests often ignore transaction costs, slippage, and liquidity issues. These factors can have a significant impact on an algorithm’s performance in live markets.

- Historical Bias: Backtesting is based on historical data, which may not accurately represent future market conditions. Past performance is not always indicative of future results.

- Limited to Known Data: Backtesting only considers data available up until the testing period. Unforeseen market events, such as economic crises or geopolitical instability, are not factored in.

What is Live Trading?

Live trading is the actual execution of trades with real money in real-time markets. Unlike backtesting, live trading operates with current market data, and every trade made is a real transaction. Live trading allows traders to assess the effectiveness of their algorithm in actual market conditions.

Benefits of Live Trading

- Real-World Performance: Live trading provides the ultimate test of how well an algorithm performs in the real market. It exposes the strategy to actual market conditions, such as liquidity, volatility, and unexpected events.

- Immediate Feedback: Traders can see the actual impact of their algorithm on their portfolio and make adjustments accordingly. This real-time feedback is essential for continuous improvement.

- Market Adaptability: In live trading, algorithms can react to real-time market conditions, making them more adaptive to sudden changes in price trends, volume spikes, or new economic data.

- Emotional Factor: Live trading tests not just the algorithm but also the trader’s emotional response to real losses and gains. This provides insights into how the algorithm functions under psychological stress.

Why is Live Trading Important for Algo Trading?

Live trading tests your algorithm in real market conditions, where factors like slippage, liquidity, and price fluctuations can affect performance. It provides real-time feedback, allowing you to adjust and fine-tune the algorithm as needed. Unlike backtesting, live trading exposes the algorithm to unpredictable events, helping you assess its adaptability and long-term viability.

Drawbacks of Live Trading

- Risk of Real Financial Loss: The most significant downside of live trading is the potential for real monetary loss. While backtesting allows for risk-free evaluation, live trading exposes traders to actual financial risk.

- Market Noise and Unpredictability: Live markets are noisy and unpredictable. Sudden events such as news announcements, economic data releases, or geopolitical tensions can cause sudden price movements, which backtests may not account for.

- Execution Issues: Live trading involves real-time execution, which can face issues like slippage, delays, or order rejections, leading to deviations from the expected performance.

- Emotional Decisions: Traders are subject to emotional decision-making when real money is involved. This can lead to impulsive actions, such as abandoning a strategy mid-trade or taking unnecessary risks.

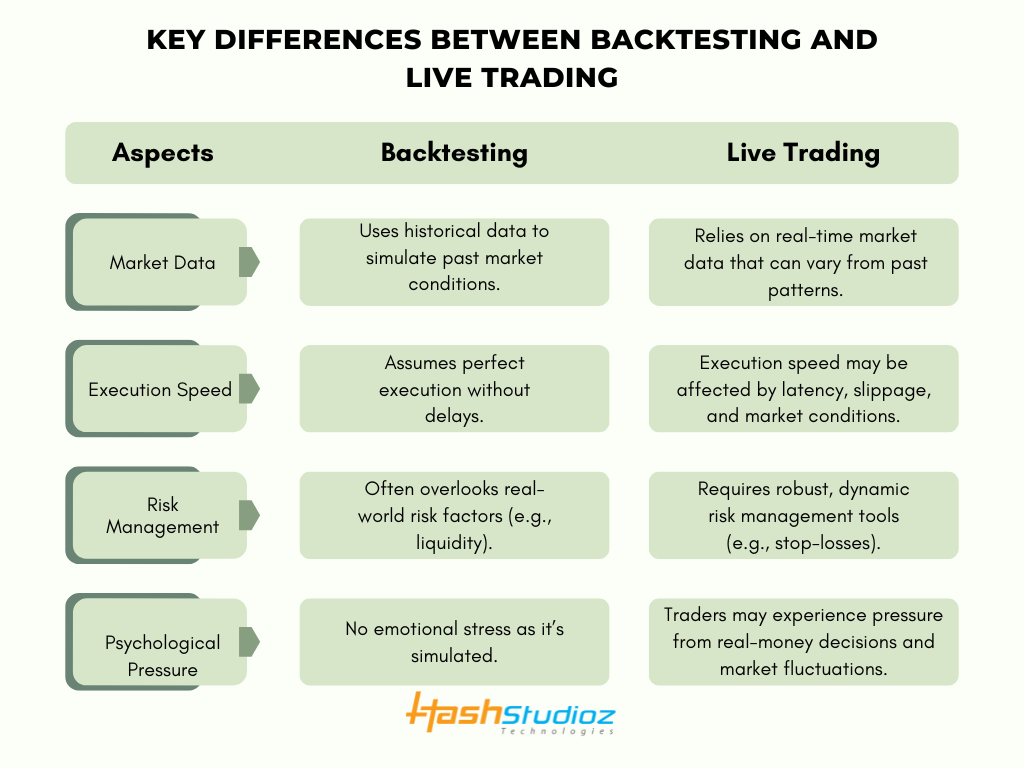

Key Differences Between Backtesting and Live Trading

- Market Data: Backtesting uses historical data, while live trading relies on real-time market data, which can vary from historical patterns.

- Execution Speed: Backtests assume ideal execution, but in live trading, slippage and delays may affect the outcome.

- Risk Management: Live trading demands robust risk management to protect against sudden market shifts, while backtesting often overlooks such challenges.

- Psychological Pressure: In live trading, traders must deal with the emotional stress of real-time decisions, which isn’t a factor during backtesting.

Key Factors for a Successful Algorithmic Trading Strategy

Achieving success with algo trading requires a combination of strategy, technology, and risk management. Here are some key factors to consider:

1. High-Quality Data

Reliable, accurate data is essential for both backtesting and live trading. Historical data must be accurate and reflect various market conditions to create a realistic backtest. In live trading, real-time data feeds must be fast and consistent to ensure timely execution of trades.

2. Effective Risk Management

Without proper risk management, even the best algorithm can fail. During both backtesting and live trading, risk controls should be in place to limit losses and protect profits. Stop-loss orders, position sizing, and diversification are all key components of a sound risk management strategy.

3. Adaptability to Market Changes

Markets are constantly evolving, and algorithms need to be able to adapt to new conditions. This is especially true for live trading, where market volatility, liquidity changes, and news events can impact performance. An algorithm that performs well today may not work in the same way tomorrow, so continuous monitoring and adjustments are necessary.

4. Execution Speed and Latency

In fast-moving markets, delays in execution can cause significant losses. For high-frequency trading strategies, low-latency execution is crucial. Both during backtesting and live trading, reducing latency can improve the algorithm’s ability to take advantage of trading opportunities.

5. Regular Optimization

Even a well-performing algorithm can become obsolete as market conditions change. Regularly optimizing your algorithm based on new data, performance feedback, and changing market trends is key to maintaining its success.

Take Your Strategy to the Next Level

Developing and optimizing a successful algorithmic trading strategy requires expert knowledge and technical precision. If you’re ready to take your algo trading to the next level, HashStudioz offers custom algo development services to help you build and optimize strategies tailored to your unique goals. Whether you’re refining your existing algorithms or creating new ones from scratch, HashStudioz can help you craft a solution designed for success in both backtesting and live trading environments.

Conclusion

Backtesting and live trading are both essential for developing a successful algorithmic trading strategy. While backtesting provides insights into a strategy’s potential performance, live trading is the ultimate test of how the algorithm functions in real-market conditions. To achieve success, it’s important to address key factors such as data quality, risk management, adaptability, execution speed, and regular optimization.

Custom algorithm development is a vital tool for traders looking to tailor strategies to their unique needs. With the right approach, continuous monitoring, and expert support, your algorithm can perform optimally in both backtesting and live trading scenarios.

Frequently Asked Questions (FAQ)

- What is the main difference between backtesting and live trading?

Backtesting involves testing an algorithmic trading strategy on historical data to evaluate its performance, while live trading executes the strategy in real-time using actual market conditions. - Why do backtesting results differ from live trading performance?

Backtesting may not account for real-world factors like slippage, market impact, liquidity constraints, and execution delays, which can affect live trading outcomes. - How can I improve the accuracy of backtesting?

Use high-quality historical data, incorporate realistic transaction costs, simulate slippage, and test across different market conditions to get more reliable backtesting results. - Is live trading necessary if my backtesting results are strong?

Yes, live trading is essential because market conditions constantly change, and backtesting cannot fully replicate real-time execution, emotions, or sudden market events.