AI Transforming Financial Planning has revolutionized the way financial services are delivered. Financial planning has traditionally been a domain requiring human expertise, detailed market knowledge, and tailored advice. With the rise of artificial intelligence (AI), this dynamic has shifted dramatically. According to a report by Statista, the assets under management (AUM) in the robo-advisory segment are projected to reach $2.73 trillion globally by 2027, growing at a compound annual growth rate (CAGR) of 14.4% from 2023 to 2027. AI in Robo-Advisory Platforms is redefining how financial services operate, providing automated, data-driven, and highly personalized solutions. A recent study by Deloitte highlighted that 62% of users prefer robo-advisors for their low costs and accessibility, with 59% citing ease of use as a major benefit. Robo-advisors are emerging as game-changers, enabling users to manage investments, plan for retirement, and achieve financial goals with minimal effort.

Table of Contents

- What Are Robo-Advisors?

- The Technology Behind Robo-Advisors

- Key Benefits of AI Transforming Financial Planning

- Real-World Statistics and Adoption Trends

- Examples of Robo-Advisory Success

- Challenges of AI in Robo-Advisory Platforms

- Future Trends in AI-Powered Robo-Advisory

- Practical Steps for Users

- Revolutionize Financial Planning with HashStudioz Technology

- Conclusion

- FAQ: How AI is Transforming Financial Planning Through Robo-Advisors

What Are Robo-Advisors?

Robo-advisors are digital financial tools that automate investment management and financial planning. Using algorithms powered by AI, these platforms analyze user data, evaluate market conditions, and offer tailored financial advice.

Initially introduced in 2008 during the global financial crisis, robo-advisors have evolved significantly. They now integrate complex AI capabilities to cater to a wide range of financial needs, including:

- Portfolio management

- Tax optimization

- Goal tracking

- Risk assessment

Unlike traditional advisors, robo-advisors are accessible online, providing services at a fraction of the cost.

The Technology Behind Robo-Advisors

The efficiency and accuracy of robo-advisors stem from advanced technologies integrated into their systems.

1. Machine Learning (ML)

Machine learning enables robo-advisors to learn from new data continuously. ML algorithms refine their predictions by analyzing user behavior and market trends and improve decision-making over time. For example:

- ML algorithms can predict stock performance based on historical patterns.

- They adjust portfolios automatically in response to market volatility.

2. Natural Language Processing (NLP)

NLP powers conversational interfaces like chatbots. These tools simplify user interaction by processing natural language queries and providing clear, actionable responses. Users can ask questions like:

- “How should I allocate my savings?”

- “What is the best investment option for me?”

3. Predictive Analytics

Predictive analytics involves analyzing historical and current data to forecast future financial trends. This capability helps robo-advisors:

- Predict market fluctuations

- Suggest optimal investment timing

- Evaluate risk probabilities

4. Big Data Analytics

Big data analytics allows robo-advisors to process vast datasets, including:

- User financial behavior

- Market indices

- Economic indicators

These insights ensure that recommendations are both accurate and tailored.

5. Cloud Computing

Cloud computing provides scalable storage and computational power. It ensures that robo-advisory platforms can handle large numbers of users while maintaining real-time processing capabilities.

AI in 5G Networks: Advancements, Challenges, and Real-World Use Cases

Key Benefits of AI Transforming Financial Planning

1. Accessibility

Robo-advisors make financial planning accessible to a broader audience, including those who may not have the resources to hire traditional advisors. Platforms like Betterment and Wealthfront offer services starting at minimal fees, democratizing financial advice.

2. Personalization

AI algorithms analyze individual financial data, such as income, spending habits, and goals, to create highly personalized strategies. For instance, a user planning for retirement in 20 years will receive different advice than someone saving for a home within five years.

3. Cost Efficiency

Traditional financial advisors typically charge fees ranging from 1% to 3% of assets under management. In contrast, robo-advisors charge significantly less, often around 0.25% to 0.50%.

4. Data-Driven Decision-Making

Robo-advisors use real-time data and predictive analytics to provide evidence-based advice. Unlike human advisors, who may rely on experience or intuition, robo-advisors focus solely on objective data.

5. Reduced Emotional Bias

Human financial advisors can sometimes make decisions influenced by emotions or personal biases. Robo-advisors eliminate this issue, ensuring decisions are based purely on data and algorithms.

Real-World Statistics and Adoption Trends

1. Market Growth

- The global robo-advisory market is projected to grow from $2.5 billion in 2024 to $16 trillion by 2030.

- In 2023, over 70% of financial institutions had integrated some form of robo-advisory services.

2. Demographic Insights

- Millennials are the largest adopters of robo-advisors, with 38% using these platforms.

- Gen X accounts for 21%, while baby boomers represent 7%.

3. Popular Platforms

- Betterment: Manages over $33 billion in assets using AI-driven algorithms.

- Wealthfront: Focuses on tax optimization and goal-based planning, with $27 billion under management.

- Acorns: Specializes in micro-investing, allowing users to invest spare change automatically.

Examples of Robo-Advisory Success

Betterment: Simplifying Wealth Management

Betterment uses AI to offer services like automated portfolio rebalancing and tax-loss harvesting. Its algorithms ensure investments align with user goals and risk tolerance, providing a seamless user experience.

Wealthfront: Comprehensive Financial Planning

Wealthfront integrates predictive analytics to offer advice on saving, investing, and debt management. Its AI-driven recommendations are tailored to user-specific timelines and financial milestones.

Acorns: Encouraging Micro-Investing

Acorns leverages big data analytics to help users invest small amounts of money. By rounding up daily purchases to the nearest dollar, it promotes consistent, automated investment growth.

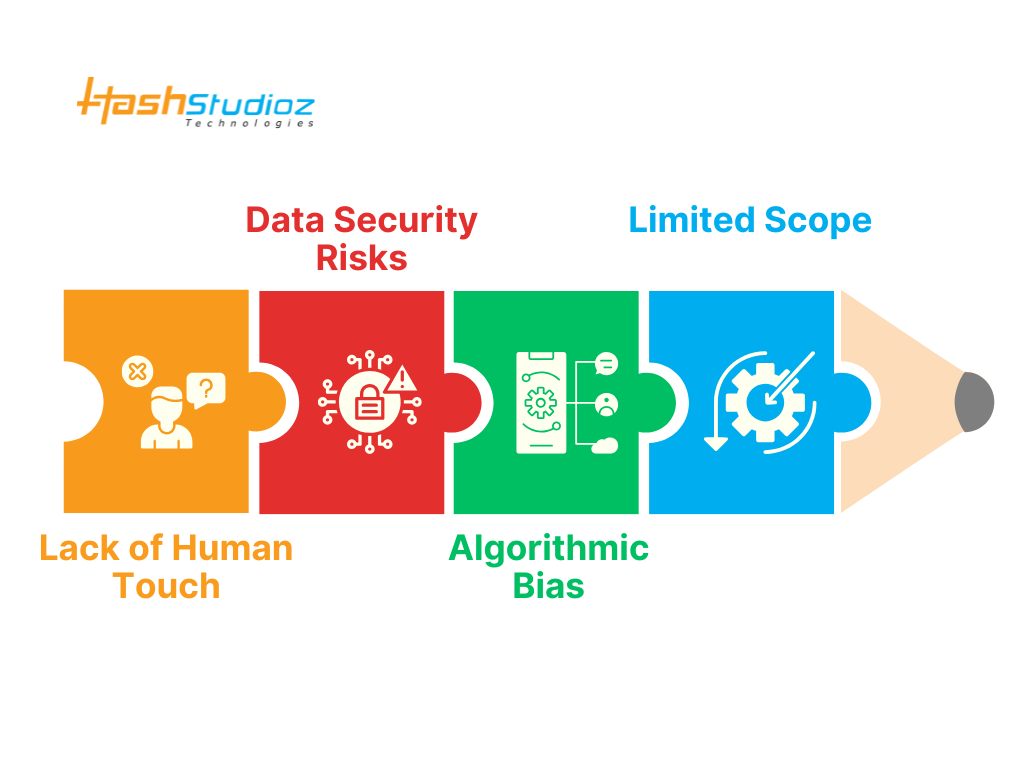

Challenges of AI in Robo-Advisory Platforms

While robo-advisors offer numerous benefits, they are not without limitations.

1. Lack of Human Touch

Complex financial situations often require human judgment, empathy, and the ability to navigate nuances. Robo-advisors may fall short in addressing these intricate needs.

2. Data Security Risks

Handling sensitive financial data makes robo-advisors prime targets for cyberattacks. Implementing robust encryption, multi-factor authentication, and regular audits is essential to mitigate these risks.

3. Algorithmic Bias

Algorithms are only as unbiased as the data they are trained on. Any bias in training data can lead to flawed recommendations, which may impact user trust.

4. Limited Scope

Robo-advisors excel in managing investments but are less effective in areas like estate planning or comprehensive tax strategies.

Future Trends in AI-Powered Robo-Advisory

The future of artificial intelligent systems in financial planning is promising, with several trends shaping the next decade.

1. Blockchain Integration

By integrating blockchain technology, robo-advisors can enhance transparency and security. Blockchain’s decentralized nature ensures that all transactions are verifiable and tamper-proof.

2. Advanced Behavioral Analytics

Future platforms may analyze user spending habits, lifestyle choices, and emotional responses to provide even more tailored financial plans.

3. Expansion to Holistic Financial Services

Robo-advisors will likely evolve to offer services beyond investment management, including tax planning, estate planning, and insurance advice.

4. Hybrid Models

Many platforms are adopting hybrid models, combining robo-advisors with human financial planners. This approach provides users with the best of both worlds—AI-driven efficiency and human expertise.

Practical Steps for Users

If you are considering using a robo-advisor, follow these steps to maximize its benefits:

1. Define Your Goals

Clearly outline your financial objectives, such as saving for retirement, purchasing a home, or building an emergency fund.

2. Assess Risk Tolerance

Understand your comfort level with investment risks. Robo-advisors often use questionnaires to help determine this.

3. Research Platforms

Compare different robo-advisors based on fees, features, and user reviews. Some popular platforms include Betterment, Wealthfront, and Vanguard Digital Advisor.

4. Monitor Performance

While robo-advisors automate financial planning, it is essential to review performance periodically to ensure your goals are being met.

Transforming Supply Chains: The Impact of AI on Modern Logistics

Revolutionize Financial Planning with HashStudioz Technology

Financial planning is rapidly evolving, driven by the integration of advanced technologies like Artificial Intelligence (AI). Businesses seeking to stay competitive and meet the growing demand for smarter financial solutions must leverage the potential of AI in Robo-Advisory Platforms.

At HashStudioz Technology, we understand the complexities of financial systems and the challenges businesses face when adopting new technologies. That’s why we specialize in creating tailored Artificial Intelligent solutions designed to transform financial services.

Our Services

As a full-service technology provider, HashStudioz offers a wide range of solutions, including:

1. AI and Machine Learning Development

- Development of intelligent algorithms for real-time financial analysis.

- Predictive analytics to identify market trends and investment opportunities.

- Custom-built AI systems tailored for financial planning and advisory needs.

2. Blockchain Development

- Secure transaction processing for financial platforms using blockchain.

- Smart contract creation for automated financial operations.

- Integration of blockchain for data integrity and enhanced platform security.

3. Cloud Computing Solutions

- Scalable cloud infrastructure to support robo-advisory services.

- Secure data storage and high-performance computing for analytics.

- Reliable cloud-based platforms for seamless operations and growth.

4. IoT Integration

- Integration of IoT-enabled devices to collect and analyze customer data.

- Advanced tools to enhance user engagement and behavioral insights.

5. Salesforce Development

- Custom CRM solutions to manage customer interactions effectively.

- Automation tools for workflow optimization and improved user experiences.

6. Travel and Marketplace Solutions

- Development of customized e-commerce and financial marketplace platforms.

- AI-driven features to enhance user experiences and engagement in financial services.

7. Robotics and Automation

- Automating repetitive financial processes to improve accuracy and efficiency.

- Deployment of robotics for task optimization and cost reduction.

Conclusion

The integration of AI in Robo-Advisory Platforms marks a significant milestone in the evolution of financial planning. By leveraging technologies like machine learning, predictive analytics, and natural language processing, robo-advisors deliver cost-effective, personalized, and data-driven solutions.

While challenges like security and limited scope exist, continuous innovation in AI is addressing these concerns. The growing adoption of robo-advisors across demographics highlights their potential to revolutionize financial planning for individuals and businesses alike.As these platforms continue to evolve, users can expect even more advanced, secure, and inclusive financial solutions, paving the way for a financially empowered future.

FAQ: How AI is Transforming Financial Planning Through Robo-Advisors

1. What is a Robo-Advisor?

A robo-advisor is an AI-powered financial tool that provides automated investment management and financial planning services. It uses algorithms to analyze user data, evaluate market trends, and offer personalized financial advice.

2. How does AI enhance robo-advisors?

AI enables robo-advisors to deliver data-driven recommendations, personalized strategies, and real-time portfolio adjustments. Technologies like machine learning, natural language processing, and predictive analytics power these platforms.

3. Are robo-advisors suitable for beginners?

Yes, robo-advisors are designed to simplify financial planning, making them accessible for beginners. They provide easy-to-understand recommendations based on individual financial goals and risk tolerance.

4. How secure are robo-advisory platforms?

Most robo-advisors implement robust security measures, including encryption, multi-factor authentication, and regular system audits. However, users should choose reputable platforms to ensure data safety.

5. What limitations do robo-advisors have?

Robo-advisors may lack the human touch needed for complex financial situations. They also focus mainly on investment management, with limited capabilities in areas like estate planning and intricate tax strategies.