Peer-to-peer (P2P) payment apps are revolutionizing the financial landscape, with over $1 trillion in P2P transactions globally in 2023, and the market is projected to reach $8.4 trillion by 2027, growing at a 24% CAGR (Compound Annual Growth Rate). In the U.S., 82% of smartphone users are estimated to use P2P payment apps by 2024, highlighting the increasing reliance on these platforms. Blockchain technology is playing a crucial role in transforming these apps, offering users enhanced security, lower transaction costs, and faster processing times. As of 2022, 60% of financial institutions were already exploring or implementing blockchain for payment solutions, demonstrating its growing impact on the financial sector.

Businesses leveraging FinTech App Development Services are now integrating blockchain to meet the rising demand for transparency, reduced fees, and borderless transactions.

Table of Contents

- What Are Peer-to-Peer Payment Apps?

- Why Blockchain Integration Is a Game-Changer

- Essential Features of Blockchain-Based P2P Payment Apps

- Step-by-Step Guide to Develop a P2P Payment App

- Step 1: Define the Scope and Target Audience

- Step 2: Select the Right Blockchain Platform

- Step 3: Choose a Reliable FinTech App Development Service

- Step 4: Develop the Digital Wallet

- Step 5: Integrate Blockchain Technology

- Step 6: Implement Smart Contracts

- Step 7: Focus on Security Features

- Step 8: Build a User-Friendly Interface

- Step 9: Test the App Thoroughly

- Step 10: Launch and Market the App

- Challenges in Developing Blockchain-Based P2P Payment Apps

- Cost Estimation for Blockchain-Based P2P Apps

- Examples of Blockchain-Based P2P Payment Apps

- The Future of Blockchain in P2P Payment Apps

- Build the Future of Payments Today with HashStudioz Technology

- Why Choose HashStudioz Technology?

- Services Offered by HashStudioz Technology

- Conclusion

- Frequently Asked Questions (FAQ)

What Are Peer-to-Peer Payment Apps?

P2P payment apps enable individuals to send and receive money directly, bypassing traditional financial institutions. These apps use digital wallets to store funds, making transactions faster and more convenient. Popular apps like Venmo, PayPal, and Cash App have paved the way for widespread adoption.

Unlike traditional banking methods, P2P apps are easy to use, cost-effective, and designed for real-time transfers. Blockchain technology enhances these apps further by adding security, reducing costs, and enabling cross-border payments without intermediaries.

Why Blockchain Integration Is a Game-Changer

1. Decentralization

Blockchain decentralizes financial transactions by eliminating the need for central authorities, such as banks. This ensures that users have direct control over their funds.

2. Enhanced Security

Blockchain secures data using cryptographic methods, making it nearly impossible for hackers to tamper with transactions.

3. Transparency

Every transaction is recorded on a blockchain ledger, ensuring complete visibility and traceability. This builds user trust and reduces disputes.

4. Reduced Costs

Without intermediaries, transaction fees are significantly lower, benefiting both users and businesses.

5. Global Accessibility

Blockchain supports multi-currency transactions, enabling seamless payments across borders. This is essential for global businesses and freelancers.

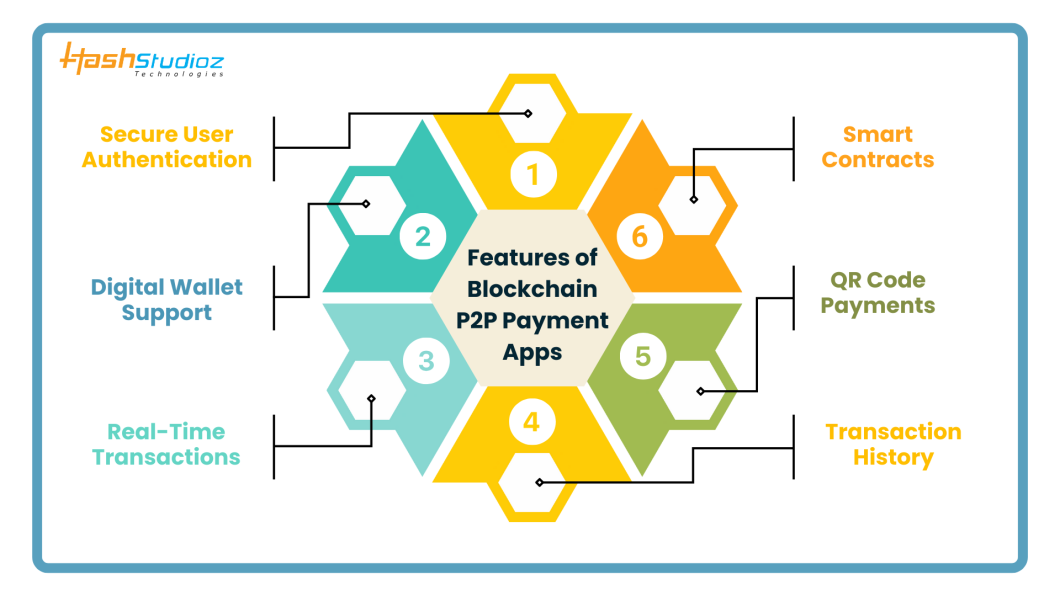

Essential Features of Blockchain-Based P2P Payment Apps

Developing a blockchain-based peer-to-peer (P2P) payment app requires incorporating features that enhance user experience, security, and functionality. Below is a detailed explanation of each essential feature:

1. Secure User Authentication

Strong user authentication is the cornerstone of a secure P2P payment app. It ensures that only authorized individuals can access their accounts and perform transactions. Methods to implement secure authentication include:

- Two-Factor Authentication (2FA): Combines passwords with a secondary verification method like OTPs or app-based tokens.

- Biometric Scans: Features like fingerprint or facial recognition provide a more secure and convenient way for users to log in.

- Hardware Tokens: Physical devices that generate unique codes, adding an extra layer of protection for sensitive transactions.

By integrating these methods, apps reduce the risk of unauthorized access, identity theft, and fraud.

2. Digital Wallet Support

A digital wallet is integral to P2P payment apps, allowing users to store, send, and receive funds. Blockchain-based wallets provide flexibility by supporting both cryptocurrencies and fiat currencies. Essential aspects of digital wallet support include:

- Multi-Currency Functionality: Enables users to transact in various currencies, making the app suitable for global audiences.

- Private Key Management: Ensures that users maintain full control of their funds, as private keys act as the gateway to their wallets.

- Backup and Recovery Options: Protect users against accidental data loss by providing recovery phrases or options.

This feature offers users the convenience of managing their funds from one platform.

3. Real-Time Transactions

One of blockchain’s key advantages is the ability to process transactions almost instantly, regardless of geographic location. Real-time transactions are critical for:

- Cross-Border Payments: Transfers between users in different countries are completed within seconds.

- Eliminating Intermediaries: Direct peer-to-peer payments reduce delays caused by bank or payment gateway approvals.

- Enhanced User Satisfaction: Faster transactions lead to a better user experience.

Blockchain technology’s decentralized nature ensures that transactions remain quick and efficient, even during high traffic periods.

4. Transaction History

Providing users with a clear record of all their past transactions fosters transparency and accountability. This feature typically includes:

- Detailed Records: Information like transaction IDs, timestamps, amounts, and parties involved.

- Searchable and Filterable Logs: Helps users quickly find specific transactions.

- Export Options: Allows users to download transaction histories for financial tracking or tax purposes.

This functionality enhances user trust and confidence in the platform.

5. QR Code Payments

QR codes simplify the payment process, especially for in-person transactions. By scanning a code, users can instantly complete payments. Benefits include:

- Ease of Use: Eliminates the need to manually input payment details, reducing errors.

- Wide Applicability: Useful for businesses, freelancers, and personal transfers.

- Seamless Integration: QR code generators can be paired with payment amounts, currencies, and recipient details.

This feature is especially valuable for retail environments or service-based businesses.

6. Smart Contracts

Smart contracts are self-executing contracts programmed with predefined conditions. They automate processes, ensuring accuracy and reducing the need for intermediaries. Use cases in P2P apps include:

- Recurring Payments: Automates monthly subscriptions or installment payments.

- Conditional Transfers: Ensures funds are transferred only when specific criteria are met, such as delivery confirmation in e-commerce.

- Escrow Services: Holds funds until all conditions of a transaction are satisfied.

Smart contracts enhance efficiency and security while reducing manual intervention.

IoT in Wireless Communication: Exploring the Best Protocols and Technologies

Step-by-Step Guide to Develop a P2P Payment App

Developing a P2P payment app with blockchain integration requires technical expertise and a strategic approach. Here’s a detailed breakdown:

Step 1: Define the Scope and Target Audience

Understand the app’s purpose and determine the target market. Decide whether it will support cryptocurrencies, fiat currencies, or both. Identify key user needs, such as speed, security, and cross-border functionality.

Step 2: Select the Right Blockchain Platform

The choice of blockchain platform is crucial for scalability, security, and speed. Here are popular options:

- Ethereum: Known for its robust smart contract capabilities.

- Binance Smart Chain: Offers low transaction fees and scalability.

- Solana: Ideal for high-speed and low-cost transactions.

- Hyperledger Fabric: Best for private blockchain networks tailored to business needs.

Step 3: Choose a Reliable FinTech App Development Service

Collaborating with a professional FinTech App Development Services provider ensures your app meets industry standards. These experts can handle complex blockchain integrations and ensure optimal performance.

Step 4: Develop the Digital Wallet

The wallet is the core of any P2P payment app. Ensure it supports encryption and multi-currency storage. A well-designed wallet will enhance user confidence and usability.

Step 5: Integrate Blockchain Technology

Use blockchain APIs and SDKs to connect the app with the blockchain network. Focus on features like:

- Transaction validation

- Data encryption

- Decentralized data storage

Step 6: Implement Smart Contracts

Smart contracts automate transactions based on predefined conditions. For instance, payments can be automatically released once delivery is confirmed.

Step 7: Focus on Security Features

Blockchain offers inherent security, but additional measures like encryption, secure APIs, and penetration testing are essential.

Step 8: Build a User-Friendly Interface

Invest in intuitive designs that cater to all demographics. Features like simple navigation, payment reminders, and transaction summaries can improve user satisfaction.

Step 9: Test the App Thoroughly

Conduct rigorous testing to identify and fix vulnerabilities. Use real-world scenarios to ensure reliability and security under different conditions.

Step 10: Launch and Market the App

Deploy the app on major platforms like Google Play and the Apple App Store. Use digital marketing strategies, such as social media campaigns and influencer partnerships, to promote the app.

Challenges in Developing Blockchain-Based P2P Payment Apps

1. Regulatory Compliance

Financial regulations vary across countries. Ensure the app complies with local laws, including anti-money laundering (AML) and know-your-customer (KYC) policies.

2. Scalability

High transaction volumes can strain blockchain networks. Choose platforms designed for scalability, like Solana or Binance Smart Chain.

3. Educating Users

Blockchain technology is still new to many users. Provide tutorials, FAQs, and customer support to help users navigate the app.

4. Cybersecurity Threats

Although blockchain is secure, apps can still be targeted by phishing attacks or malware. Regular updates and monitoring are crucial.

5. High Initial Costs

Developing and maintaining a blockchain-based app requires significant investment. Partnering with FinTech App Development Services can optimize resources and reduce costs.

Cost Estimation for Blockchain-Based P2P Apps

The cost of developing a blockchain-based P2P payment app depends on various factors, including complexity, features, and development time.

- Basic App: $20,000–$50,000

- Advanced App with Blockchain: $70,000–$150,000

- Enterprise-Level App: Over $200,000

Examples of Blockchain-Based P2P Payment Apps

1. Circle Pay

Circle Pay leverages blockchain for secure and fast cross-border payments. It supports multiple currencies, including cryptocurrencies.

2. BitPay

BitPay specializes in cryptocurrency payments, offering low transaction fees and enhanced security.

3. Metal Pay

Metal Pay rewards users with cryptocurrency for transactions, encouraging app adoption.

These examples demonstrate how blockchain improves P2P payment apps by providing innovative features and reducing costs.

Building Offline-First iOS Apps: Handling Data Synchronization and Storage

The Future of Blockchain in P2P Payment Apps

The global blockchain market is expected to grow from $7.18 billion in 2022 to $67.4 billion by 2026, according to MarketsandMarkets. This growth highlights the increasing adoption of blockchain in various sectors, especially FinTech.

With evolving consumer expectations and technological advancements, P2P payment apps will likely incorporate more blockchain-based features. Trends like decentralized finance (DeFi), stablecoins, and tokenized assets are shaping the future of digital payments.

Build the Future of Payments Today with HashStudioz Technology

In today’s fast-paced digital world, Peer-to-Peer (P2P) payment apps are transforming the way people exchange money. Integrating blockchain technology into these apps not only enhances security and transparency but also provides users with faster and more affordable transactions. If you’re ready to build a future-proof, innovative P2P payment app, HashStudioz Technology is your ideal partner.

At HashStudioz Technology, we specialize in FinTech App Development Services that leverage cutting-edge technologies like blockchain. Our team of experts understands the nuances of developing secure, scalable, and user-friendly P2P payment platforms. Whether you’re building an app from scratch or enhancing an existing one, we ensure seamless integration of blockchain technology to enable faster payments, reduce transaction fees, and increase trust through transparent records.

Here’s how we can help:

1. Blockchain Integration: We integrate blockchain to facilitate secure, real-time, cross-border payments without the need for intermediaries.

2. Custom App Development: Our team builds customized P2P payment apps that cater to your business requirements and user needs.

3. Scalability and Security: We focus on creating apps that grow with your business while maintaining the highest security standards.

With HashStudioz Technology, you can be assured of high-quality, reliable, and innovative solutions that will help your business lead in the competitive FinTech market.

Why Choose HashStudioz Technology?

HashStudioz is more than just a technology partner. We are a team of experienced professionals dedicated to helping businesses thrive in a digital-first world.

- Expertise: A decade of experience in delivering successful projects across industries.

- Custom Solutions: Tailor-made services to meet your unique needs.

- Agility: Rapid development cycles for faster time-to-market.

- Innovation: Cutting-edge tools and technologies to give your business a competitive edge.

- Customer Focus: 24/7 support and a client-centric approach to ensure satisfaction.

Services Offered by HashStudioz Technology

HashStudioz Technology provides a range of innovative solutions to help businesses stay competitive. Our key services include:

1. Internet of Things (IoT): We create connected systems for smart devices and industries, enabling automation and data-driven insights.

2. Blockchain Development: We offer blockchain consulting, smart contract development, and secure decentralized applications.

3. Salesforce Development: Custom CRM solutions, Salesforce integration, and app development to optimize customer relationships and sales.

4. Travel Technologies: We develop travel portals, mobile apps, and software solutions for seamless booking and travel management.

5. Cloud Computing: Cloud migration, infrastructure management, and secure app development to enhance scalability and efficiency.

6. E-commerce Solutions: Custom e-commerce platform development, payment integration, and mobile apps to improve online shopping experiences.

7. Marketplace for Services: Development of secure online marketplaces and mobile apps for efficient buyer-seller interactions.

8. Artificial Intelligence (AI): Artificial Intelligence chatbots, business intelligence, and machine learning models to enhance customer support and data insights.

9. Machine Learning (ML): Tailored Machine Learning models, data analytics, and integration to improve business processes.

10. Robotics: Robotic process automation (RPA) and custom robotic solution to optimize operations across industries.

Conclusion

Developing a blockchain-based P2P payment app is an excellent opportunity to address the growing demand for secure, efficient, and transparent digital transactions. Businesses can gain a competitive edge by combining blockchain’s capabilities with expert FinTech App Development Services.

The process involves careful planning, from choosing the right blockchain platform to ensuring regulatory compliance. By integrating features like smart contracts, multi-currency wallets, and real-time transactions, businesses can create apps that meet the needs of modern users.

Investing in blockchain-based P2P payment apps is not just about staying competitive; it’s about driving innovation in the FinTech industry.

Frequently Asked Questions (FAQ)

1. What is a Peer-to-Peer (P2P) Payment App?

A P2P payment app allows users to transfer funds directly to one another without needing intermediaries like banks. Examples include PayPal, Venmo, and Cash App.

2. Why Use Blockchain for P2P Payment Apps?

Blockchain enhances P2P payment apps by offering transparency, security, decentralization, and reduced transaction costs. It eliminates intermediaries and ensures trust through distributed ledger technology.

3. Can I Add Cryptocurrency Support to My App?

Yes, cryptocurrency support can be integrated using APIs and wallets compatible with blockchain platforms. This enables users to make and receive payments in crypto.

4. What Are Smart Contracts, and Why Are They Important?

Smart contracts are self-executing contracts with predefined conditions coded into them. They ensure secure, automated, and tamper-proof transactions in P2P payment apps.

5. Do Blockchain-Based P2P Apps Support Cross-Border Transactions?

Yes, blockchain allows seamless cross-border payments by eliminating currency exchange intermediaries and reducing delays.